child tax credit october payments

It is possible that these advance payments of the Child Tax Credit will continue into 2022 as it was part of the Build Back Better Act which failed to pass. That said the Child Tax Credit payments you receive during 2021 are based on the IRS estimate of your 2021 Child Tax Credit eligibility from your 2020 return.

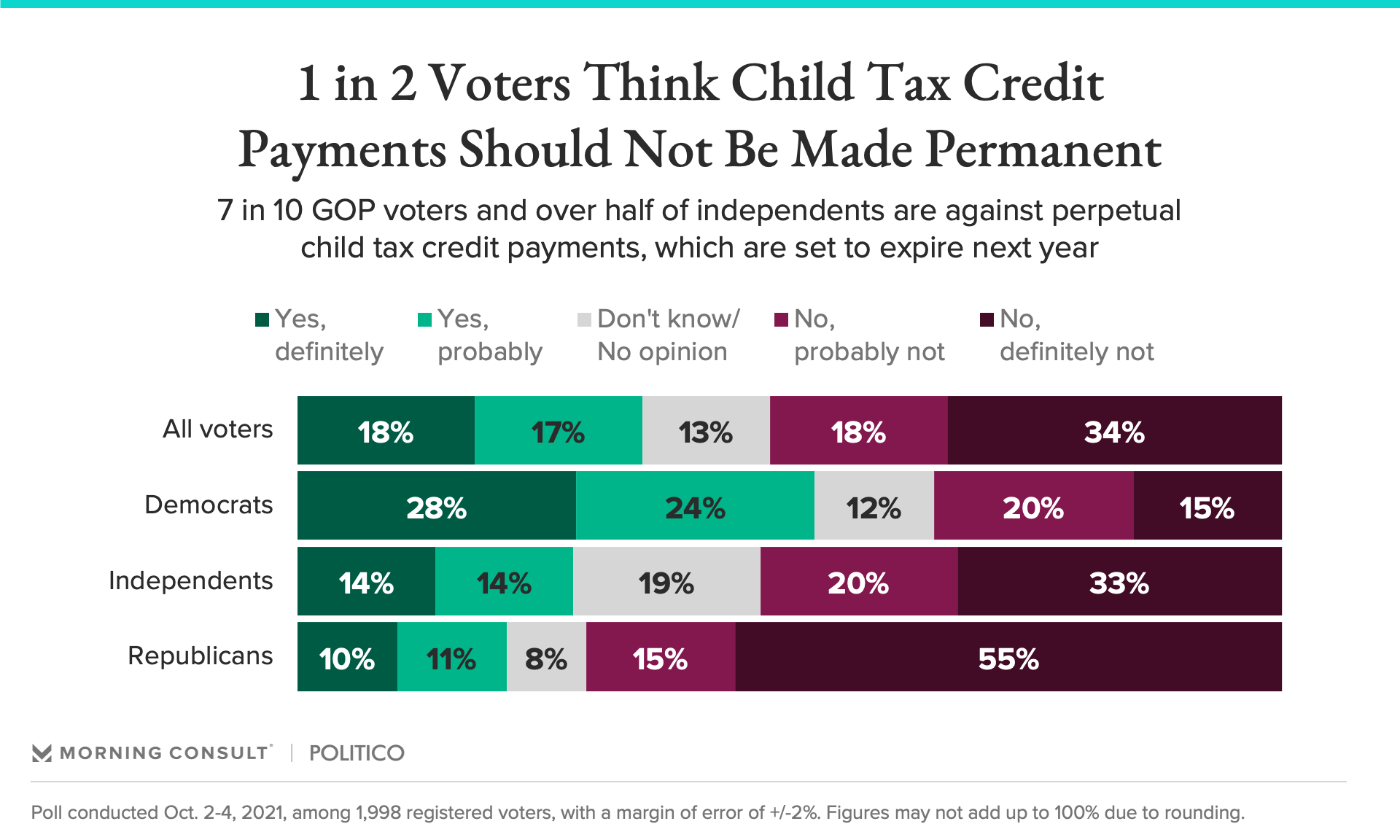

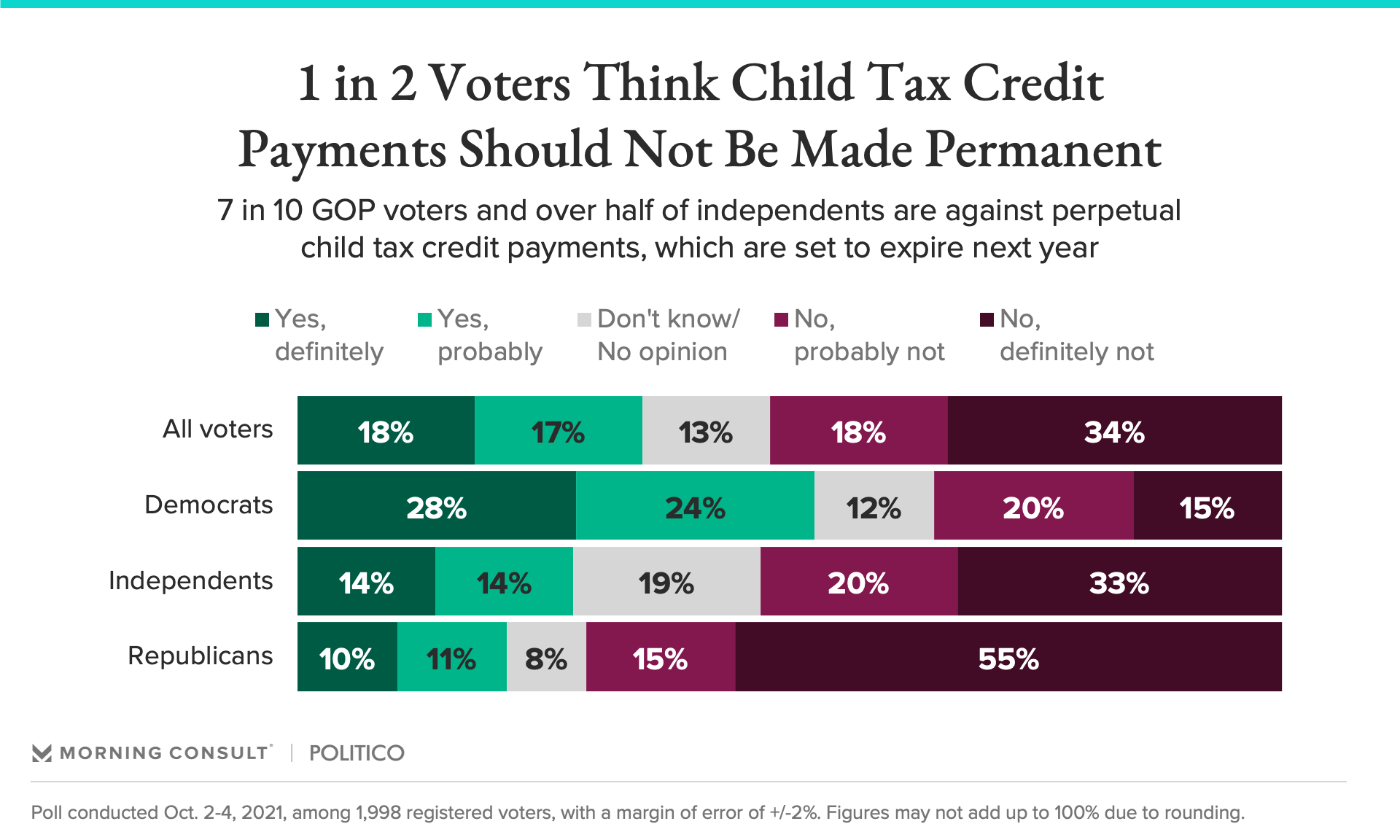

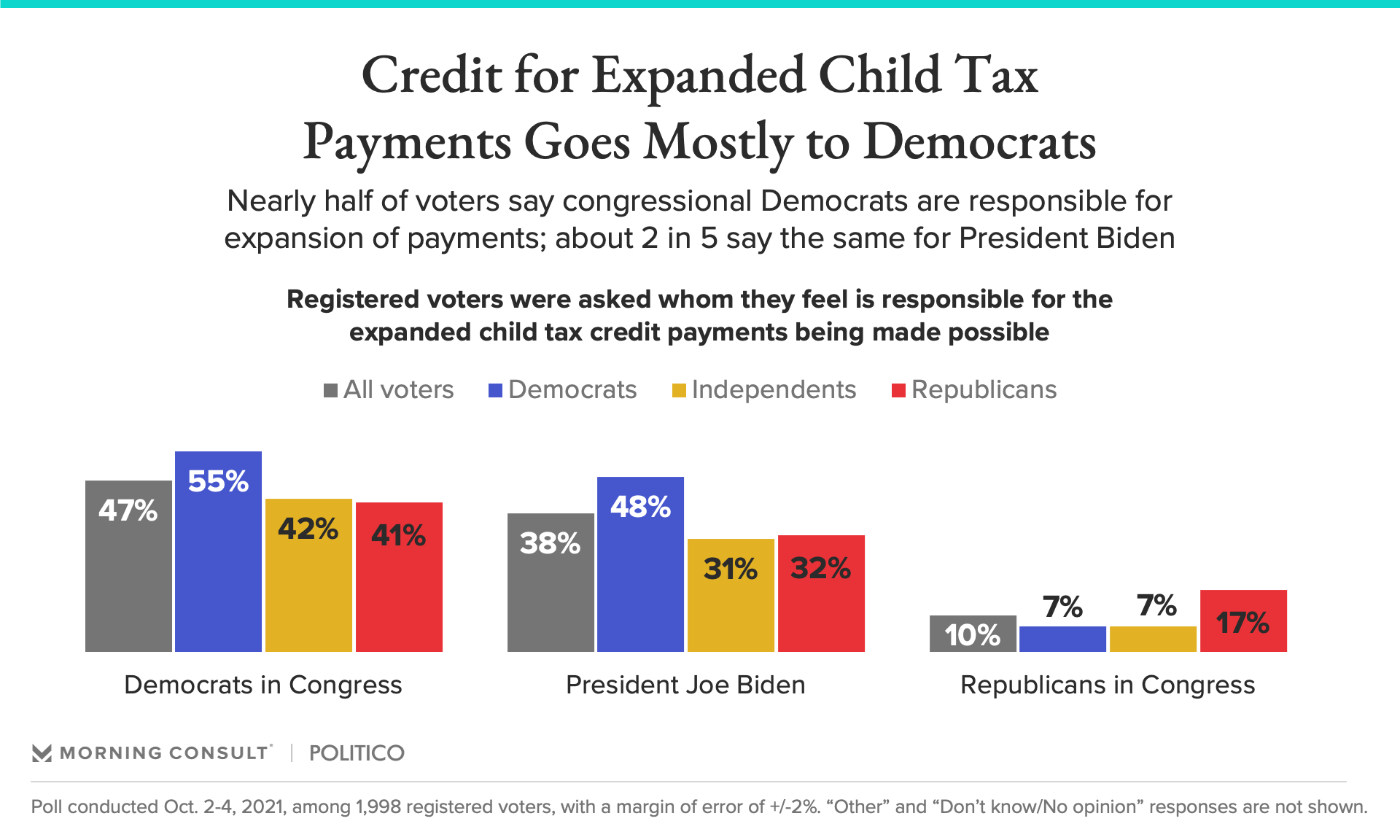

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

Eligible families have received monthly payments of up.

. But since families can start filing their 2021 income tax returns collecting the other half of the credit as a lump sum the realization that the expanded child tax credit is dead may be delayed. Child Tax Credits land in families bank accounts 0030. Families that received their initial payment in.

The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 3600 to 3600 for each qualifying child under the age of six beginning in tax year 2021 the taxes you file in 2022. Of the 546 million households eligible for CTC recipients were more likely to be employed at. The monthly child tax credit payments have come to an end but more money is coming next year.

Additional information about the IRS portal allowing you to follow update or even opt-out of the new payments will also be provided. The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year. If you end up receiving more than what you ultimately qualify to receive when you file your 2021 tax return you may have to pay back some of the money.

You may have heard that the IRS will be sending monthly stimulus payments or monthly Child Tax Credit payments to some families starting in July. Millions of families who received a monthly payment from the IRS through the expanded child tax credit are facing their first month since July without cash from the federal program even as. The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021The tool below is to only be used to help you determine what your 2021 monthly advance payment could have been.

The monthly child tax credit payments millions of American parents may have gotten used to over the past six months wont be landing in wallets this week. If you were eligible to receive advance Child Tax Credit payments based on your 2020 tax return or 2019 tax return including information you entered into the Non-Filer tool for Economic Impact Payments on IRSgov in 2020 or the Child Tax Credit Non-filer Sign-up Tool in 2021 you generally received those payments automatically without. See below for more information.

Parents who received advance Child Tax Credit payments last year did not leave the workforce as some feared according to a new analysis with lower earners increasingly seeking out entrepreneurship. The 2022 tax season could trigger headaches as the IRS deals with a back load of returns and filers address key paperwork for the child tax credit. Families with 60 million children were sent the first monthly check.

IRS Child Tax Credit Portal and Non-filers. The Child Tax Credit CTC for 2021 has some important changes stemming from the American Rescue Plan ARP. However if you still havent received any checks or if youre missing money from one of the months.

Learn what the changes are who qualifies payment amounts and when those payments will be issued. About 35 million US. The federal Child Tax Credit is kicking off.

Child Tax Credit 2021. Your child tax credit payments will phase out by 50 for every 1000 of income over those threshold amounts according to Joanna Powell. If you received the advance child tax credit payments and a stimulus payment in 2021 as many families did youre going to need to hold onto two types of different letters from the IRS Letter.

Monthly child tax credit payments were a godsend for many parents who struggled financially in 2021. Here is what you need to know. The advance Child Tax Credit or CTC payments began in July 2021 and end.

The recently passed third stimulus relief package known as the American Rescue Plan expanded the Child Tax CreditBeginning with your tax year 2021 taxes the ones filed in 2022. If you are eligible for the Child Tax Credit but did not receive advance Child Tax Credit payments you can claim the full credit amount when you file your 2021 tax return during the 2022 tax filing season. The enhanced child tax credit payments are only set to last through 2021 but President Biden has suggested that this may be extended through as long as 2025 as part of the American Families Plan.

Payments roll out starting July 15 heres when the money will land 0532.

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

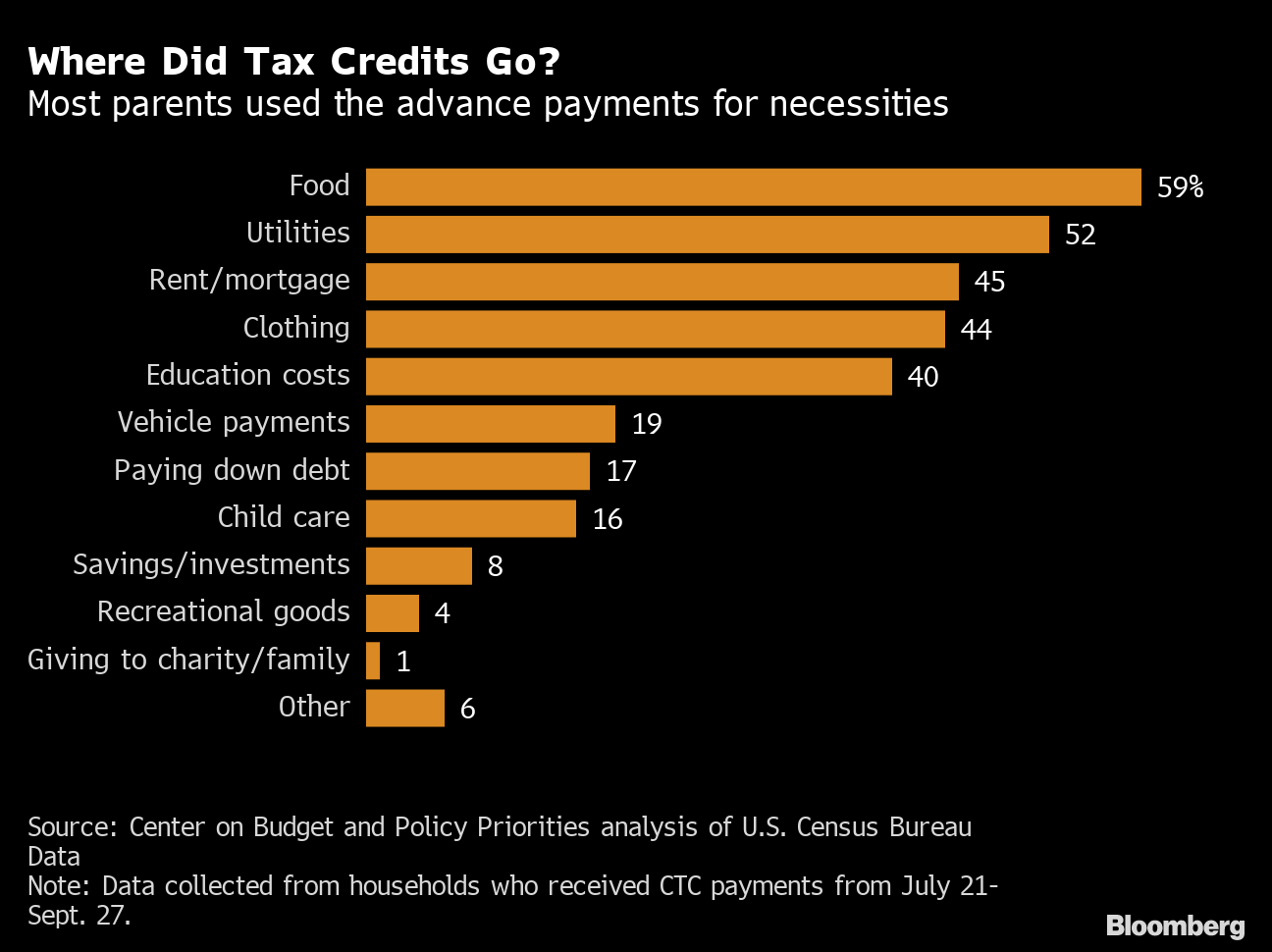

Child Tax Credit 2021 Joe Manchin Opposes Aid Parents Are Using For Food Rent Bloomberg

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Explainer What Are The Child Tax Credits Democrats Are Battling Over Reuters